What is a Payment Service Provider

A payment service provider (PSP) refers to a third-party solution that enables businesses to accept a variety of online payment methods by connecting them to the broader financial system.

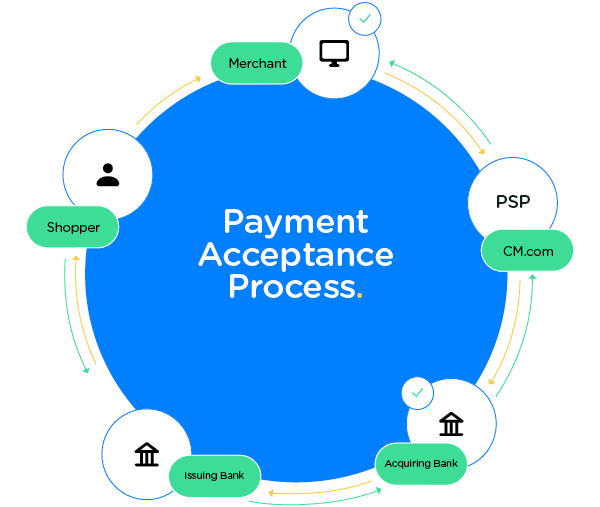

Payment service providers facilitate payment transactions between eCommerce and mCommerce merchants and their customers. From the moment a customer enters their payment details to the second the funds clear in the merchants’ account, the payment service provider works on their behalf with banks, card schemes, and payment platforms to make sure the payment is processed, and the transaction goes through successfully.

Payment service providers bring each party in the chain together, including the merchants, customers, banks, card networks, and payment platforms. This helps ensure a fast, seamless, and secure payment experience for businesses and their customers.

A payment service provider manages the payment process in its entirety:

- A customer attempts to pay for an item or service online (for example with a credit card)

- Transaction details are sent to the acquiring bank (merchants bank), its role is to exchange funds with the issuing bank (customers bank) and ensure that the merchant receives their payment

- The transaction details are then passed over to the credit card network – such as MasterCard, Visa, or iDEAL

- These transaction details are sent to the issuing bank, which decides whether to approve the payment based on e.g. the buyer’s financial status and 3DS consent

- The issuing bank passes on their decision to the credit card network, which passes it onto the acquiring bank

- Following payment authorization, the issuing bank sends funds to the card network

- The card network then passes funds to the acquiring bank, which then deposits them into the payment service provider’s merchant account

- The payment service provider then notifies the business and customer that the payment has been completed

- Finally the payment service provider pays the amounts received towards their merchant

Why Use a Payment Service Provider?

You can use a payment service provider to accept a range of payments from your customers via one gateway including debit cards, credit cards, mobile wallet payments, and more. The majority of payment service providers provide both local and global payment methods and accept payments in a range of currencies – making them a secure and effective way to accept payments from customers around the world.

What Are the Benefits of a Payment Service Provider?

Additional benefits you’ll experience when using payment service providers:

- Online payment transactions are swift, secure, and efficient

- Payment service providers are cost-effective, they typically offer affordable rates to merchants

- Simplicity: you have one basic contract and access to a wide variety of payment methods

- Customers have a range of online payment methods to choose from, making it easier for them to find the ideal way to pay for them

- Payment service providers cut admin time for businesses

- They offer cost-efficient security (such as PCI compliance)

- Payment service providers also identify any potential instances of fraud

- The ability to accept global payments in a range of currencies

Get Started

Get access to a range of online payment methods and solutions and ensure secure, fast, and affordable payment transactions with a payment service provider. Payment service providers dial back your admin time, making them a no-brainer for your payment transactions.

Read how to choose the right payment service provider for your business.