What Is Wero – And Why Now?

Wero is Europe’s answer to a fragmented payment landscape. It aims to provide a consistent payment experience for all European consumers, bringing the simplicity and speed of iDEAL with new payment capabilities that work anywhere in Europe.

Wero will support payments online, in-store and even peer-to-peer, combining iDEAL’s familiar online payments features with other payment functionalities.

Online payments

Contactless POS payments

Subscriptions and recurring payments

Pay-on-delivery

One-click payments

Event-based and split payments

Loyalty programs

Payment requests

Wero is governed by 16 leading European banks and financial institutions. For Dutch consumers, the transition to Wero will feel seamless, as all major Dutch banks are participating, and 13 of the 14 iDEAL banks are already actively involved.

For merchants, their current iDEAL provider will guide them through the transition and will continue to be their main point of contact as they also become their Wero provider.

For more information on Wero, read our blog Wero Explained: The Future of Payments Across Europe.

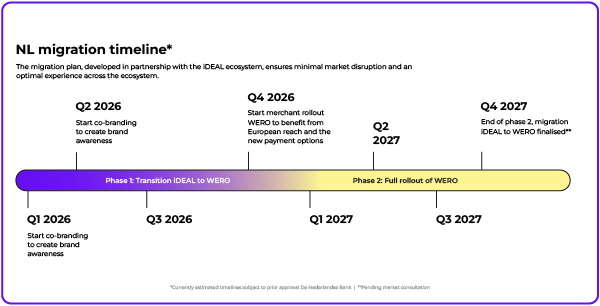

How the iDEAL to Wero Migration Will Work (Timeline & Phases)

Businesses are considering what Wero transition will mean for them. The move from iDEAL to Wero will take place in phases to ensure the experience for both consumers and merchants remains smooth.

Phase 1 (Q1 2026 - Q3 2026):

Co-branding from iDEAL to Wero

8 January 2026 – A national media campaign launches to announce that iDEAL is transitioning to Wero

15 January 2026 – Banks will start communication to consumers about logo change to ensure trust and familiarity

29 January to 31 March 2026 – Co-branded iDEAL | Wero logo replaces current iDEAL logo and naming

Merchants receive a toolkit to update logo’s and branding in time

Existing iDEAL contracts will remain valid

The payment experience remains the same for consumers

Phase 2 (Q4 2026 – end 2027):

Full Wero implementation & iDEAL phase-out

The co-branded iDEAL | Wero logo is replaced by the Wero logo

iDEAL will be phased out*

Wero transactions are accepted on the Wero infrastructure

Merchants sign a Wero contract with their current iDEAL provider

Advanced features, including in-store payments, subscriptions, loyalty and more will be introduced in 2027

*Final sunset date of iDEAL is pending consultation

iDEAL providers will define their specific migration strategy and will ensure merchants are informed about the timing, alongside any potential impacts on technical teams. iDEAL’s rules and processes will remain in place throughout the co-branding phase. When businesses transition to a full Wero contract and branding, Wero’s purchase protection will also become available.

Why Wero Benefits Your Business: Reach, Speed & Omnichannel Payments

Key benefits for businesses include:

Europe-wide reach, instant settlement

Sell to customers across borders, starting with The Netherlands, Belgium, Luxembourg, Germany and France, using secure, bank-authorized instant payments.

Simplified checkout and fewer integrations

Support more payment scenarios with one solution instead of multiple local methods.

True omnichannel payments

Unify online and in-store payment data for better insights and simpler customer communications.

Low fraud risk with proven banking security

Strong Customer Authentication and SEPA Instant Credit Transfers reduce the risk of unauthorized payments and limit exposure to chargeback fraud common with card payments.

During the co-branding phase, your iDEAL integration remains active, with no major operational changes expected. When the full rollout happens, your iDEAL provider, like CM.com, will support the integration and contractual updates needed to go live with Wero.

How Wero Improves the Customer Experience

At first, almost nothing changes. The familiar iDEAL checkout experience remains, helping build early trust in the Wero brand. Customers continue paying directly from their bank app — no cards, no IBAN entry. They simply use their banking app, similar to iDEAL, or the Wero app.

Once Wero is fully live, consumers gain access to a single digital wallet for everything. This wallet will allow customers over time to manage all payment activities in one place: online, in-store, subscriptions, loyalty programs, BNPL and peer-to-peer payments.

How Online Wero Checkout Works:

Customer selects Wero at checkout

Desktop: Scan a QR code to open their banking or Wero app and confirm the payment

Mobile: The banking or Wero app opens automatically after tapping the "pay with Wero" button. The user confirms the payment in-app

Payment is taken instantly, and the order is processed

With strong branding, national campaigns and merchant toolkits, conversion should remain protected while consumer trust grows. Purchase protection and enhanced consent flows will provide additional peace of mind.

How CM.com Supports Your Wero Migration

The transition to Wero represents a long-term shift toward secure, frictionless, scalable European commerce.

At CM.com we are working to ensure that the migration of iDEAL and other payment methods that will be replaced by Wero goes as smoothly as possible for our merchants. Updates, guidance and support will be provided at every stage of the transition in The Netherlands and beyond.

Now is the moment to get prepared and unlock the opportunities ahead.